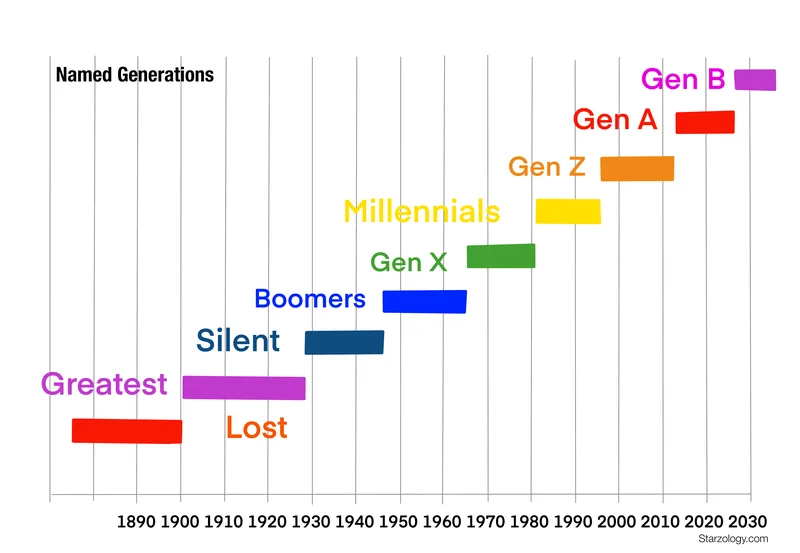

Gen Z Years: Pinpointing the Actual Birth & Age Range

Title: Gen Z's Retirement Obsession: A Calculated Hedge Against Boomer Regret?

The Generational Divide: Savings Edition

Vlad Tenev over at Robinhood is making waves with his observation that Gen Z is diving into retirement accounts at 19. Nineteen! As someone who was busy perfecting my ramen recipe at that age, it's a bit of a head-scratcher. Tenev posits that Gen Z's fiscal conservatism is a reaction to the struggles of older generations, particularly Baby Boomers, who are increasingly "unretiring" due to financial pressures. This narrative—young savers versus struggling elders—is compelling, but let's dig a bit deeper.

The Vanguard study cited in the article indicates that only 40% of Baby Boomers are on track to maintain their current lifestyle in retirement. That's a problem, a big one. The Standard Life survey shows that 14% of Boomers and older Gen Xers have already unretired, with another 4% considering it. Inflation, apparently adding $1,250 to annual household bills, is the culprit. But is it just inflation? Or is it a cocktail of factors, including under-saving, poor investment choices (the dot-com bubble anyone?), and unforeseen healthcare costs? (I've seen retirement plans torpedoed by a single unexpected illness.)

Tenev connects Gen Z's saving habits to a broader trend of embracing retro culture—vinyl records, cassette tapes, and, apparently, sound financial planning. The analogy is interesting, but it's also a bit too neat. Are 19-year-olds really thinking, "I love my Walkman, therefore I should max out my 401k?" Or is something else driving this behavior?

The Tech-Savvy Safety Net

Here's where I think the narrative gets interesting: Gen Z is hyper-aware of risk. They've grown up in the shadow of economic crises, climate change, and social unrest. They've witnessed the precarity of the gig economy and the erosion of traditional job security. Is their early adoption of retirement savings a genuine embrace of tradition, or a calculated hedge against an uncertain future?

And what about the role of technology? Robinhood, the very platform Tenev leads, has democratized access to financial markets. Young people can open accounts, research investments, and track their progress with a few taps on their phones. This ease of access, coupled with a constant stream of financial information (sometimes accurate, often not), could be fueling Gen Z's early adoption of retirement savings. They are more exposed to financial information than any generation before them.

But let's not paint too rosy a picture. The article also mentions Gen Z's tendency towards dark humor and their recognition of inequality in death. A 20-year-old student quoted in the piece points out that "rich people get to die peacefully in their beds," while others face debt or mass casualty events. This cynicism, while unsettling, also suggests a pragmatic understanding of the world. They see the game, and they're trying to play it smarter.

It's also worth noting that Gen Z's risk assessment isn't limited to personal finance. A separate article highlights Gen Z's potential to disrupt emerging markets through protests fueled by social media. These protests, often leaderless and spontaneous, are a direct response to corruption, inequality, and a lack of opportunity. The common thread? A deep-seated distrust of established systems and a willingness to challenge the status quo.

A Cynical Strategy, or Just Smart?

So, what's driving Gen Z's retirement obsession? Is it a genuine embrace of tradition, a reaction to Boomer regret, or a calculated hedge against an uncertain future? I suspect it's a bit of all three. They're risk-averse, tech-savvy, and acutely aware of the economic realities facing older generations. They're also inheriting a world riddled with problems, from climate change to political instability. Their early adoption of retirement savings may be less about nostalgia and more about survival. As boomers are forced back to work because they can't afford to retire, Robinhood CEO says Gen Z are opening retirement accounts at 19 years old.

Is This "Retirement" Even Achievable?

Here's the question I keep coming back to: Are these "retirement accounts" actually going to provide a comfortable retirement? Or are they just another tool in a system that increasingly favors the wealthy? Will climate change, healthcare costs, or unforeseen economic shocks derail their plans? And what happens when Gen Alpha (the generation after Gen Z) enters the workforce with even more debt and even less job security?

The article doesn't address the specifics of Gen Z's investment strategies. Are they investing in traditional stocks and bonds, or are they chasing the latest crypto craze? Are they diversified, or are they putting all their eggs in one basket? Details on their actual asset allocation would tell us far more than just knowing they are opening accounts.