Bitcoin at $94K: Crash or Comeback? - Price Crash Reactions

2025-12-01 15:20:391

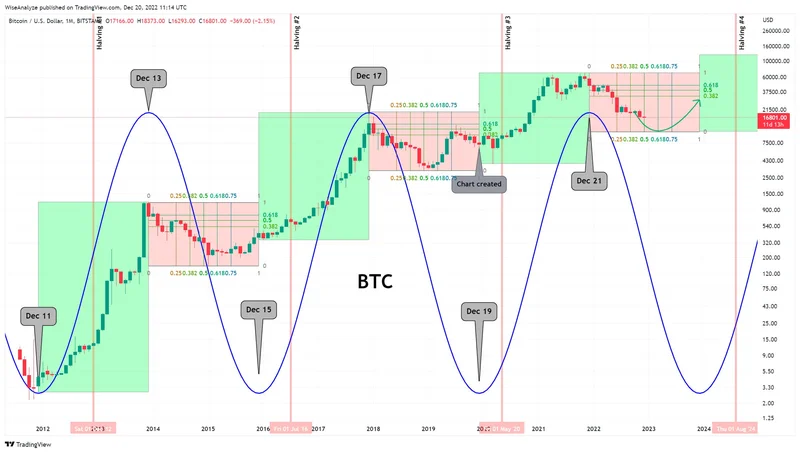

Alright, let's dissect this Bitcoin dip to $94K. Is it a buying opportunity, or are we staring into the abyss of a bear market? Forget the hype; let's look at what the numbers are actually telling us.

Bitcoin's "Macro Demand Region": Wishful Thinking?

The Technicals: A Murky Picture First, the technical analysis. Bitcoin's recent slide has landed it in the $94K–$96K range, a zone that's supposedly a "macro demand region." The bulls are hoping this area will act as a springboard, but the charts paint a less optimistic picture. The price is languishing below both the 100-day and 200-day moving averages (MAs), which are now acting as resistance. The rejection from the 100-day MA at $110K triggered a selloff, sweeping away the $99K–$100K liquidity cluster. The four-hour chart shows a "full bearish sequence" after breaking from a rising wedge. Ouch. A retest of the trendline near $106K–$108K was rejected, confirming the shift from support to resistance. To see any short-term strength, Bitcoin needs to reclaim the $101K–$103K liquidity pocket. Otherwise, more pain is likely. But technicals are just one piece of the puzzle. What does the on-chain data say?Bitcoin's Tug-of-War: Short-Term Pain, Long-Term Gain?

On-Chain Insights: The Battle Between Short and Long Term Here's where it gets interesting. The realized price distribution across UTXO age bands reveals a tug-of-war between short-term and mid-term holders. Bitcoin has dipped below the realized prices of the 1–3 month and 3–6 month cohorts. These groups are now sitting on losses, meaning their realized price levels have transformed into "realized supply." This creates an overhead resistance band between $105K and $110K. In contrast, the 6–12 month cohort remains in profit, with a realized price around $94K–$96K. This aligns with the current market support. This group is historically more resilient, often acting as a stabilizing force during corrections. The article I'm looking at suggests this is a late-stage shakeout, where long-term participants absorb supply from capitulating short-term holders. The crypto execs are all chiming in too, of course. One is saying that long-term holders are finally cashing in after an extraordinary run. At the same time, spot Bitcoin ETFs and other vehicles that were huge buyers earlier in the cycle have swung to net outflows just as global markets have turned more risk-off and rate-cut hopes have been pushed out. Crypto execs speculate on what’s to blame as Bitcoin slumped under $94K The Fed Factor: A Methodological Critique Speaking of rate-cut hopes being pushed out, let's talk about the Fed. One source notes that the Federal Reserve's recent actions and cautious messaging have contributed to broader risk aversion across markets. The Fed delivered a 25-basis-point cut last week as widely expected, but Chair Jerome Powell's restrained tone dampened risk appetite after he hinted that December's cut isn't guaranteed. Now, this is where I start to get skeptical about the data *gathering*. How do you *quantify* "risk aversion" or the impact of "Powell's restrained tone?" It's squishy, and that makes me nervous. We're talking about probabilities collapsing from 96% to below 70% based on *sentiment*. Sentiment is notoriously fickle.NUPL's Mixed Signals: Bargain or Bear Trap?

The Analyst's Perspective And this is the part of the report that I find genuinely puzzling. We have analysts pointing to on-chain data suggesting further weakness ahead based on the Net Unrealized Profit/Loss (NUPL) metric. Bitcoin's NUPL sits at 0.47, the lowest level since April 8 when it fell to 0.42. During that earlier cycle, Bitcoin's NUPL declined in three stages: 0.48 on February 26, 0.44 on March 10, and 0.42 on April 8, before Bitcoin rallied from $76,000 to above $125,000. The immediate test is $100,000 psychological level (-4.1% combining 50% Fib + June lows), first target $92,000-$94,000 (-11.8% to -9.9% representing 61.8% Fib + 100% extension). So, what's the takeaway? The data is mixed, but leans bearish. The technicals are weak, with Bitcoin struggling to break above key moving averages. On-chain data shows a battle between short-term and long-term holders, with the potential for further downside if the $94K–$96K support level fails. The Fed's cautious stance isn't helping, and sentiment remains fragile. It's Not a Bargain, It's a Warning